Apple Pay has been live in the UK since 2015 and has grown to become a formidable force in the country's payments landscape. Initially designed as the frictionless alternative to traditional wallets, this service has expanded its reach and changed the way millions of people make transactions every day.

This article takes a look at why Apple Pay is so popular, its impact in-store and online, and why its future seems brighter than ever in the UK.

Front-Runner for Digital Wallet Usage

The number of people in the UK using digital wallets has grown sharply since they first became available, and there's no doubt that Apple has made its mark. A report by Finder suggests that Apple Pay is comfortably the most popular mobile wallet in the UK, commanding the vast majority of the market share.

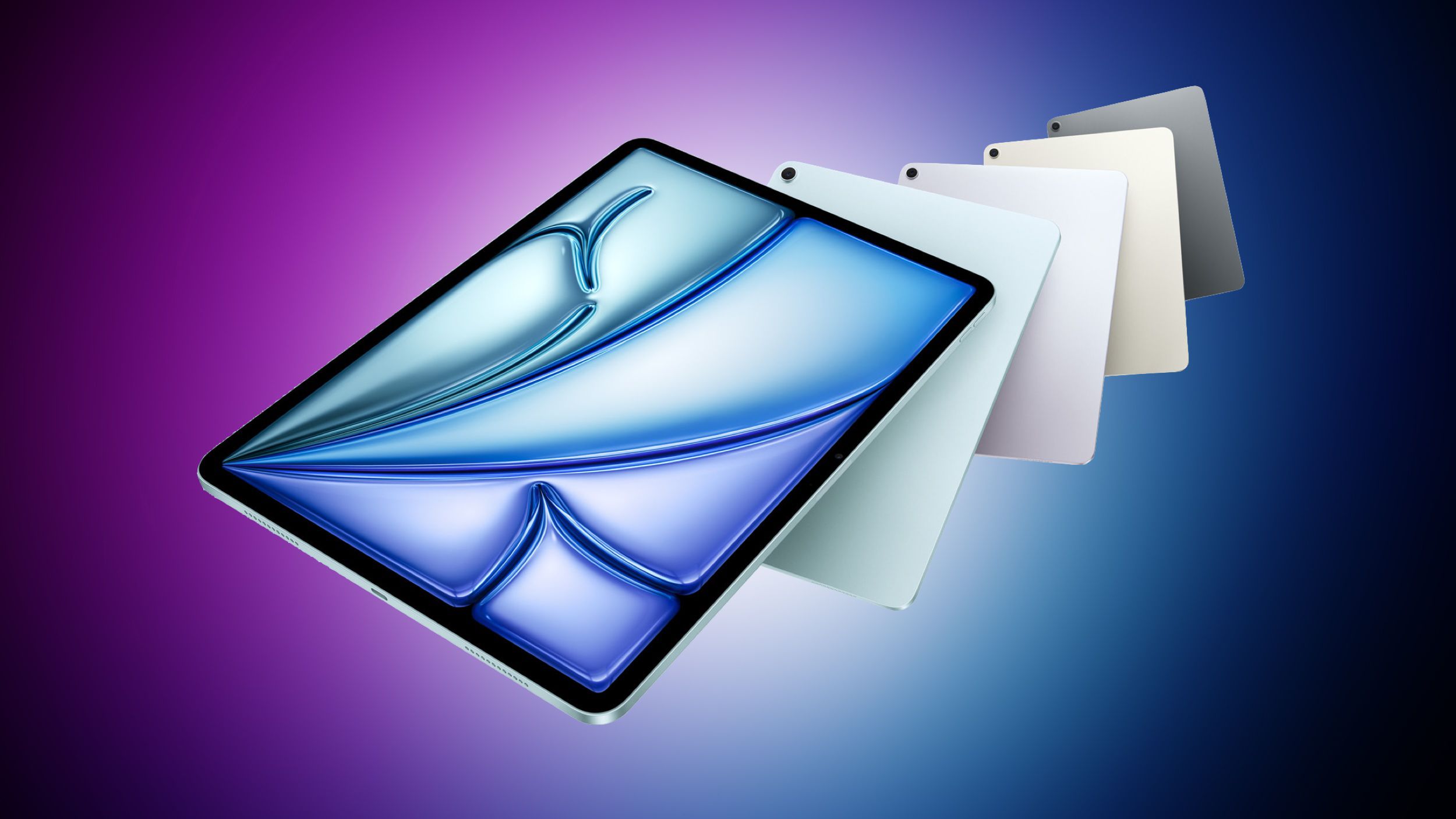

There are many reasons for this. The continued shift towards contactless payments instead of cash has been a big driver, and Apple's ability to integrate payments into its ecosystem has been key. You can now use this service on your iPhone, Apple Watch, Mac, iPad, and more which means it's simple to conduct transactions both in person and online.

As is usual with Apple's products, user satisfaction is high with many people being completely confident using it. Adding your bank card takes just a few minutes and is saved for future use. All transactions are highly secure, using biometrics for approval when needed and strong encryption at all times.

The Impact on In-Person Payments

There's no doubt that in-store, face-to-face transactions have been completely changed by mobile wallets. As contactless transactions have become the norm, Apple Pay is fast becoming one of the primary ways consumers buy goods quickly and easily within physical stores.

The majority of retailers, from huge supermarket chains down to one-off independent shops, have moved to accommodate this trend by offering it at their point-of-sale terminals. While many other contactless payments such as debit cards have a £100 limit, Apple Pay is often able to bypass this due to the added security it offers - subject to the merchant's approval. This means you can enjoy speedy payments even with higher-value purchases, such as buying electronics or high-end retail goods.

Ultimately, it's the ease of holding a device near the terminal and authorising the payment in seconds that has attracted people, instead of needing to carry an extra card and enter PIN numbers.

Apple Pay and Online Payments

The dominance of Apple Pay does not end here, with even online payments undergoing a significant change. From purchasing clothes, booking holidays, or making payments for streaming services, consumers can checkout in just a second without having to enter any card information manually.

One area where Apple Pay has had a particularly notable impact is the UK's online casino sector. British players are increasingly choosing it for gaming transactions as you can deposit from your preferred bank card in seconds without sharing any card information. Because of this trend, there's been an increase in Apple Pay casinos within the UK as sites keep up with technological trends to attract more players.

Overall, despite many other online payment methods being available, the convenience of Apple Pay has helped it become the outstanding option for users paying over the internet. It will pop up as soon as you reach the checkout, giving players no reason to choose anything else.

Continued Growth in the Next 10 Years & More

Looking ahead, Apple Pay is well-positioned to continue its growth in the UK. Although most UK businesses already accept this payment method, any that don't will soon have no choice if they want to stay competitive. As many young consumers continue to turn to digital wallets instead of traditional cards or cash, retailers need to keep adapting to this.

The UK's banking sector is also pushing this shift as most of them offer special benefits and rewards to their clients using Apple Pay. This acts as an extra incentive for people to use it over other options.

Of course, this payment method is only available for people who use Apple devices. An Android version is unlikely to ever appear considering that they are direct competitors. This means there will always be a bottleneck with total users as many people in the UK use Android devices.

However, the number of Apple devices in circulation is likely to continue to grow, offering their payment service a larger base of potential users in future. Also, as the company continues to innovate and release new products, we can expect Apple Pay to be fully integrated, making it even easier to purchase items moving forward.